The 4 Essential Client Habits Every Financial Advisor Must Master

Sep 25, 2025

If you’re a financial advisor, your calendar is probably bursting at the seams.

Back-to-back client meetings. Calls with wholesalers. Compliance reviews. Market updates. Portfolio rebalancing. Team meetings. Paperwork. Networking events. Email follow-ups. Social media content. Somewhere in there you’re also trying to stay healthy, spend time with family, and actually think strategically about your business.

It’s no wonder so many advisors feel like they’re treading water. The urgent pushes out the important. In the middle of all this noise, it’s easy to default to “checking the box” with client communication instead of intentionally cultivating it. Yet the one thing that drives retention, referrals, and long-term success isn’t just technical performance — it’s trust. And trust is built, brick by brick, through communication habits.

That’s why the most effective advisors deliberately anchor their busy schedules around four core habits. These habits become non-negotiables, woven into the fabric of their day and week. They’re not extra tasks; they’re the foundation of a thriving practice. When you master them, you create client relationships that are deeper, more resilient, and far more referable.

Below are the four essential client habits every advisor must develop, along with practical ways to integrate them into your already full schedule.

1. The Research Habit – Become an Expert in Your Company and Products

Before you can effectively serve your clients, you must master your own landscape — your company, its values, and the financial products you offer. Knowledge breeds confidence, and confidence builds trust. When you know your offerings inside and out, you can confidently match them with your clients’ needs and explain them clearly under pressure.

- Know Your Products. Understand every feature, benefit, and limitation. Be able to articulate them in plain language.

- Understand Industry Trends. Carve out 15 minutes a day or an hour a week to read market and regulatory updates so you’re always ahead.

- Competitor Awareness. Know what others offer and how you differentiate. This isn’t about bashing competitors but about clearly communicating your edge.

- Master Your Company’s Story. Clients don’t just buy products; they buy into your company’s values and vision. Be able to share it succinctly.

Pro Tip: Clients can tell when you truly believe in what you offer. The more confident and informed you are, the more trust you’ll build. Even five focused minutes of product study before each client meeting can elevate your credibility.

2. The Story-Catching Habit – Become an Expert in Your Client’s Story (All 7 Levels)

Great financial advisors don’t just collect data, they collect stories. Every client has a unique life journey, aspirations, fears, and financial goals. Your job is to become a Story Catcher by listening deeply and understanding all seven levels of their story:

- Personal Background. Their family, upbringing, values, and what shaped them.

- Career & Financial History. How they’ve earned and managed money over time.

- Dreams & Goals. Retirement, business ownership, travel — what do they truly want?

- Financial Fears. Market volatility, debt, legacy concerns — what keeps them up at night?

- Current Financial Reality. Income, assets, liabilities, and current financial strategies.

- Investment Mindset. Risk tolerance, beliefs about money, and past investment experiences.

- Legacy & Impact. What they want to leave behind for family, charities, or future generations.

Pro Tip: Ask exceptional, open-ended questions at every meeting. Instead of “What are your financial goals?” try “Tell me about a moment in your life that made you rethink your financial future.” Over time, build a living client profile that captures more than just numbers, it captures meaning.

Time-Saver: Integrate story-catching into your normal review process. Use the first five minutes of every client review to ask one deeper question. By the end of the year you’ll know far more about your client than most advisors ever will.

3. The Trust-Building Habit – The Foundation of Frequent & Healthy Communication

Trust is not a one-time event, it’s built over time through consistent, meaningful interactions. The best advisors establish trust by being present, asking exceptional questions, and actively listening.

- Be Present. Show up fully engaged in every meeting. No distractions, no rushing. Even 30 seconds of silent centering before a call can help you reset.

- Ask Exceptional Questions. Go beyond surface-level planning. Dig deeper into motivations and fears.

- Listen With Intent. Silence is powerful. Let your clients process and respond. Reflect back what you’ve heard so they know you understand.

Pro Tip: The most successful advisors don’t just communicate when a transaction happens, they communicate regularly. Create a cadence: weekly check-ins, monthly updates, annual financial vision meetings. Trust is built through consistency, not just charisma.

Time-Saver: Batch your proactive touches. For example, dedicate one afternoon a week to call three clients simply to check in, no agenda, no pitch. Those small touches compound into big loyalty.

4. The Trust-Speaking Habit – Casting Vision & Presenting Solutions That Align With Clients’ Needs

Trust doesn’t stop at understanding your client’s needs, it continues when you can confidently cast a vision for their financial future. This is where your research and their story converge.

- Speak With Clarity. Explain financial concepts in a way your client understands. Use analogies, visuals, or stories to simplify complex ideas.

- Align Solutions With Their Story. Every recommendation should connect directly to their dreams, fears, and goals.

- Sell With Integrity. Trust-speaking is not about pushing products. It’s about guiding clients to solutions that truly serve them.

Pro Tip: When presenting investment options, frame it around their story. Instead of saying, “This fund has a strong historical return,” say, “This investment aligns with your goal of retiring at 55 and spending summers in Italy.”

Time-Saver: Prepare a “client vision” slide or one-page summary before key meetings that shows how your recommendations map to their stated goals. It saves time in the meeting and underscores that you’ve been listening.

Putting It All Together: The Trust Communication Loop

When you combine these four habits, you create a self-reinforcing cycle of trust.

✅ Research → ✅ Catch Stories → ✅ Build Trust → ✅ Communicate Vision → 🔁 Repeat.

The more you commit to these habits, the stronger your client relationships will be. In a world where products can be copied and fees compressed, your habits become your true differentiator. This isn’t extra work on top of your already full schedule — it’s the work that makes everything else pay off.

Next Steps

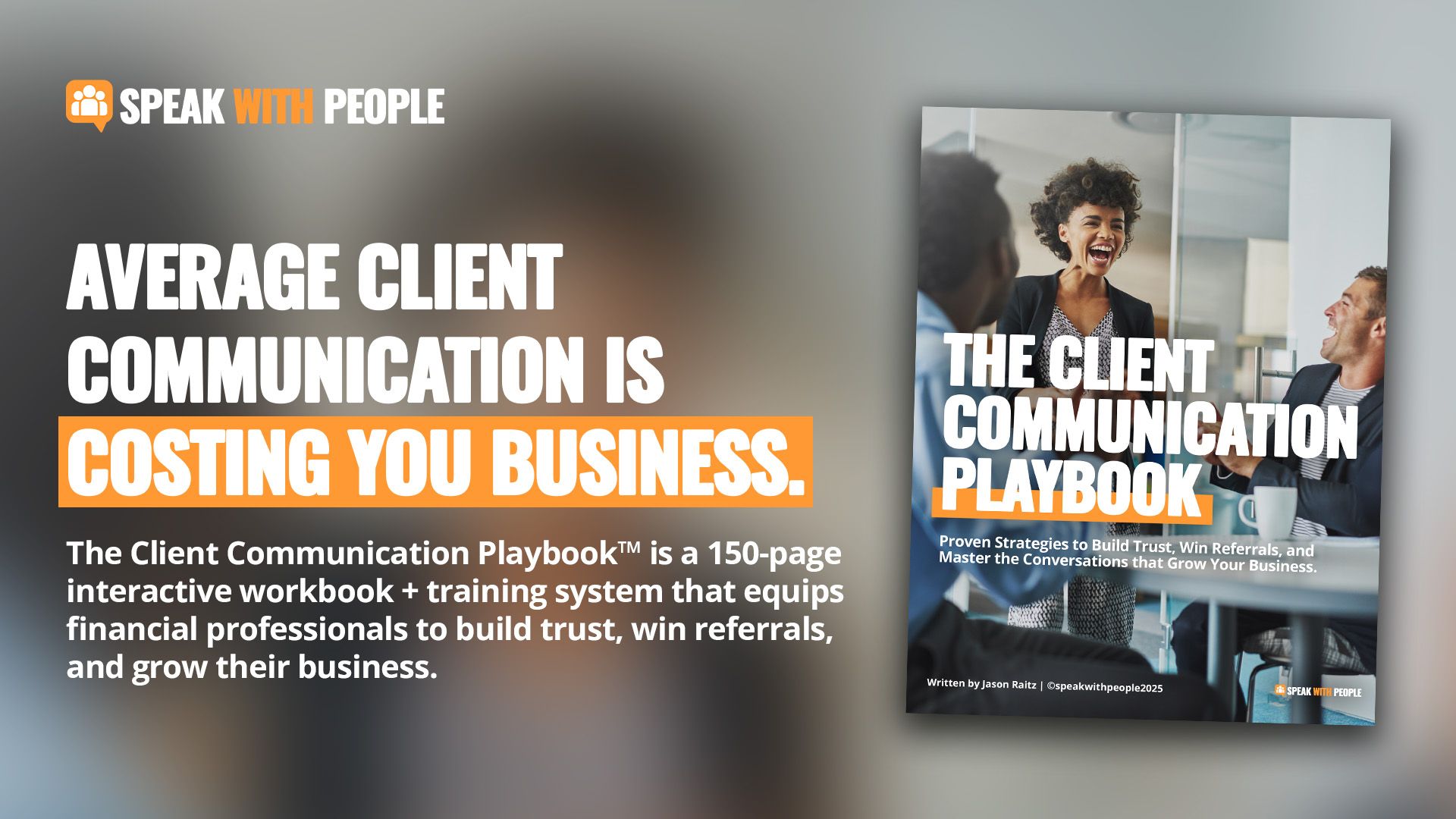

Buy the Playbook

Walk into every client meeting knowing exactly what to say, what to ask, and how to leave with trust, loyalty, and referrals. The Client Communication Playbook™ is your field-tested blueprint for becoming the advisor clients brag about. Packed with proven frameworks, assessment tools, and ready-to-use scripts, it takes the guesswork out of every interaction and helps you transform your communication into loyalty, influence, and steady referrals.

Subscribe to INSIGHTS

Get the proven scripts, strategies, and follow-up tools top advisors use to grow their business, keep clients for life, and get referrals without feeling salesy. With INSIGHTS, you’ll receive more than just tips, you’ll get real, client-tested tactics delivered monthly that you can apply immediately. Gain frameworks that remove guesswork, referral-seeding habits that feel natural, and communication strategies that truly move the needle so you can sharpen your edge where it matters most.

Even in the busiest weeks, these four habits will keep you anchored. They’ll help you move from surface-level conversations to transformational relationships and from being just another advisor to becoming your clients’ most trusted advisor.

By Jason Raitz - CEO, Speak with People With over 25 years of experience, Jason has spoken from stages across the country, inspiring and motivating his audiences with stories, laughter, and practical tools to succeed. Book Jason for your next conference or workshop.